CFO Guide: How AP Automation Supercharges Your Financial Performance

The position of CFO has evolved into one of the most intricate and challenging roles within the C-suite. Beyond financial proficiency, successful CFOs must now excel in strategic decision-making, risk management, and stakeholder relations. This diverse skill set is crucial for navigating today's increasingly intricate business terrain and the complex financial and regulatory landscapes.

Automation, when employed correctly, can be one of the most sure-fire paths to improving resilience, capacity for making strategic decisions, and overall performance in the CFO’s office.

In the case of accounts payable, automation contributes to general financial health in a number of ways – improved efficiency, greater strategic influence in vendor relationships, empowerment for team members’ career growth, and a dramatic raise in profit margins.

Challenges of traditional AP processes

While automating accounts payable is consistently ranked as a top priority by CFOs, many companies are still struggling to make their digitization vision a reality. One of the main reasons for this is bias for the status quo and inertia. Doubling down on existing processes may be tempting and limit an organization’s ability to innovate. This is why clear communication and developing stakeholder buy-in is critical to the success of any AP automation project.

Your success is far more likely when all involved understand the challenges posed by traditional/manual processes, and the benefits that automation can introduce.

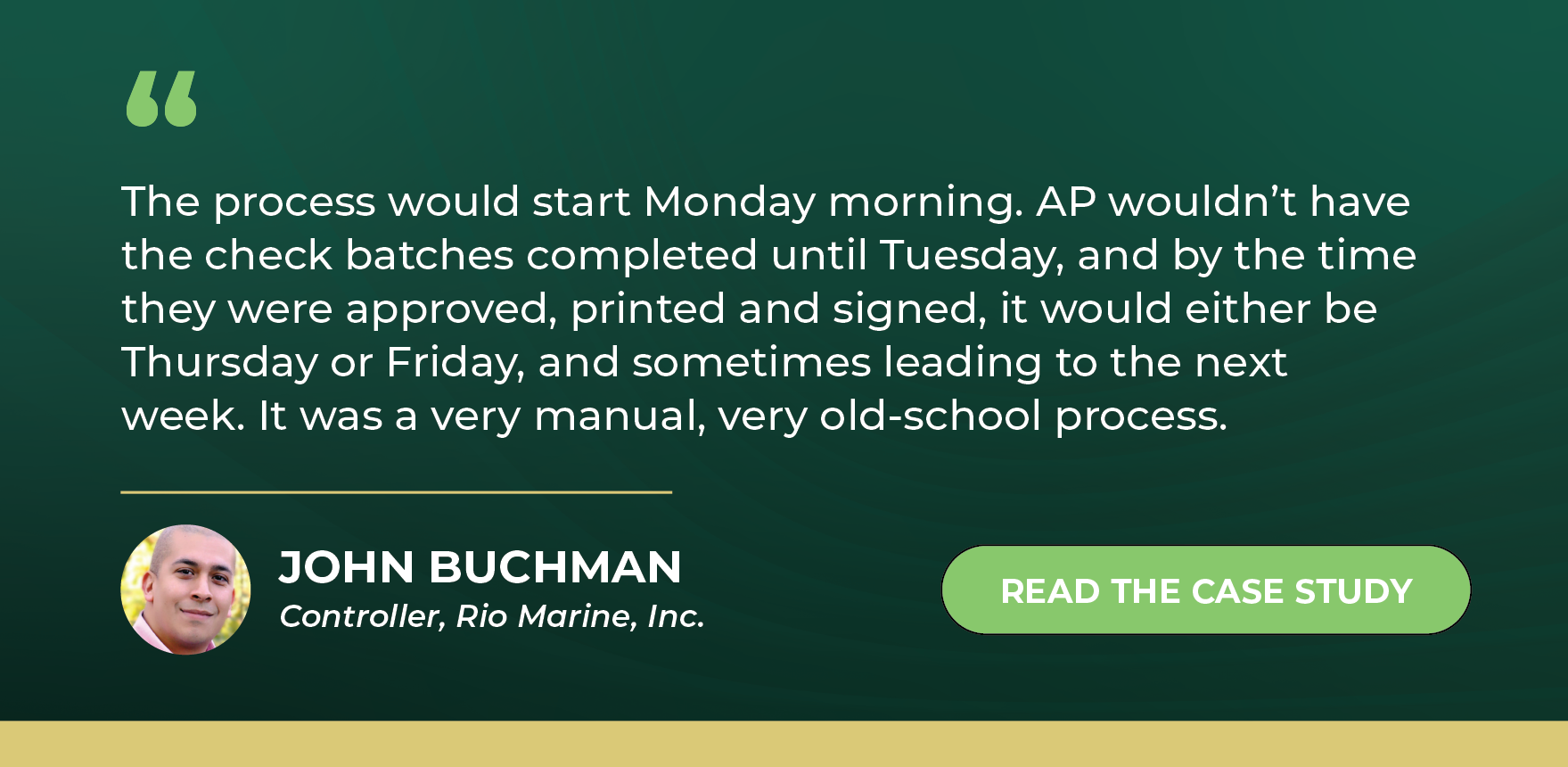

Traditional processes simply take too long to complete. In one of the cases we analyzed, the AP department needed a full week to complete a single pay run. They relied on limiting factors like requiring the team to be present at the office, and for payment approvers to physically sign every check.

The challenges created by manual processes went beyond inefficiency. Because physical signatures were required, approvers had to review expected payments alongside one-offs. This opens room for fraudulent transactions to slip through in a stack of checks that need to be signed or for simple errors to go unnoticed.

Traditional processes also lack real-time visibility into financial data and can lead to delays in decision-making. It limits the company’s ability to track expenses, understand cash flow, and identify market trends - which can impact profitability, operational efficiency, and competitive positioning in dynamic market landscapes.

Scaling a company with manual AP processes also poses compliance challenges, especially with ever-evolving regulations. As a business grows, its ability to adapt to changing regulatory requirements becomes crucial, and it can require additional resources and expertise to manage it. With manual processes taking up so much time and reduced visibility, the risk of non-compliance may grow significantly.

Core benefits of automating AP

Implementing AP automation offers significant benefits for CFOs and their teams. By automating their AP processes, CFOs can significantly reduce manual effort and processing time, leading to improved efficiency and accuracy and lowering costs. Beyond this, AP automation can introduce specific benefits that improve a company’s financial performance:

- Optimized cash flow management: Improving controls over vendor payments directly benefits cash flow management and forecasting. With an AP automation system, CFOs can optimize cash flow by speeding up invoice processing and payment approvals, which reduces cycle times and ensures payments are made on time. This in turn can lead to early payment discounts and improved relationships with vendors, which can then help companies maintain a positive cash flow.

- Improved visibility into financial health: Financial visibility also increases with AP automation. Improved visibility into payment statuses and historical data leads to better forecasting and enables CFOs to be more proactive

in their management and fiscal control.

This allows CFOs to anticipate cash flow needs, identify potential bottlenecks, and optimize working capital management. It also facilitates more accurate budgeting and planning, ensuring that financial resources are allocated efficiently to support strategic initiatives and growth opportunities.

Process efficiency and cost-savings: As mentioned earlier, automating AP operations helps lower costs and improve efficiency by streamlining invoice processing, reducing manual errors, and eliminating paper-based tasks. This accelerates payment cycles, optimizing cash flow and potentially securing early payment discounts.

Another significant but often forgotten benefit is that it empowers teams to grow and scale their processes, knowledge, and skillsets. As manual work decreases, clerks can focus on strategic activities, personal growth, enhancing productivity and overall operational efficiency.

Integrating your AP automation system

Choosing an AP automation solution that integrates seamlessly with your existing ERP system is crucial. It helps ensure that all the benefits mentioned above are well-captured, maintains data consistency, eliminates duplicate entries, and simplifies workflows.

With an embedded solution, businesses can rest assured that their automation streamlines processes, reduces errors, and provides a unified view of financial data without introducing new challenges such as integration breakdowns or departmental misalignment.

Capturing the benefits

As your business navigates the complexities of AP automation, it's important to choose a solution that aligns with your unique business model and requirements. This ensures that your system complements the existing processes you choose to retain, addresses key pain points, and enhances operational efficiency.

At Mekorma, we understand the importance of finding the right AP automation solution. Our solutions streamline AP processes within Dynamics 365 Business Central, Dynamics GP, and Acumatica, offering an efficient way to manage your finance function. Explore our comprehensive solutions for AP automation today to optimize your AP processes.