Remote Payment Services

Send your Payments to the Cloud

Accomplish More, Work Less

Unburden your Accounts Payable team with a fully integrated payment automation solution.

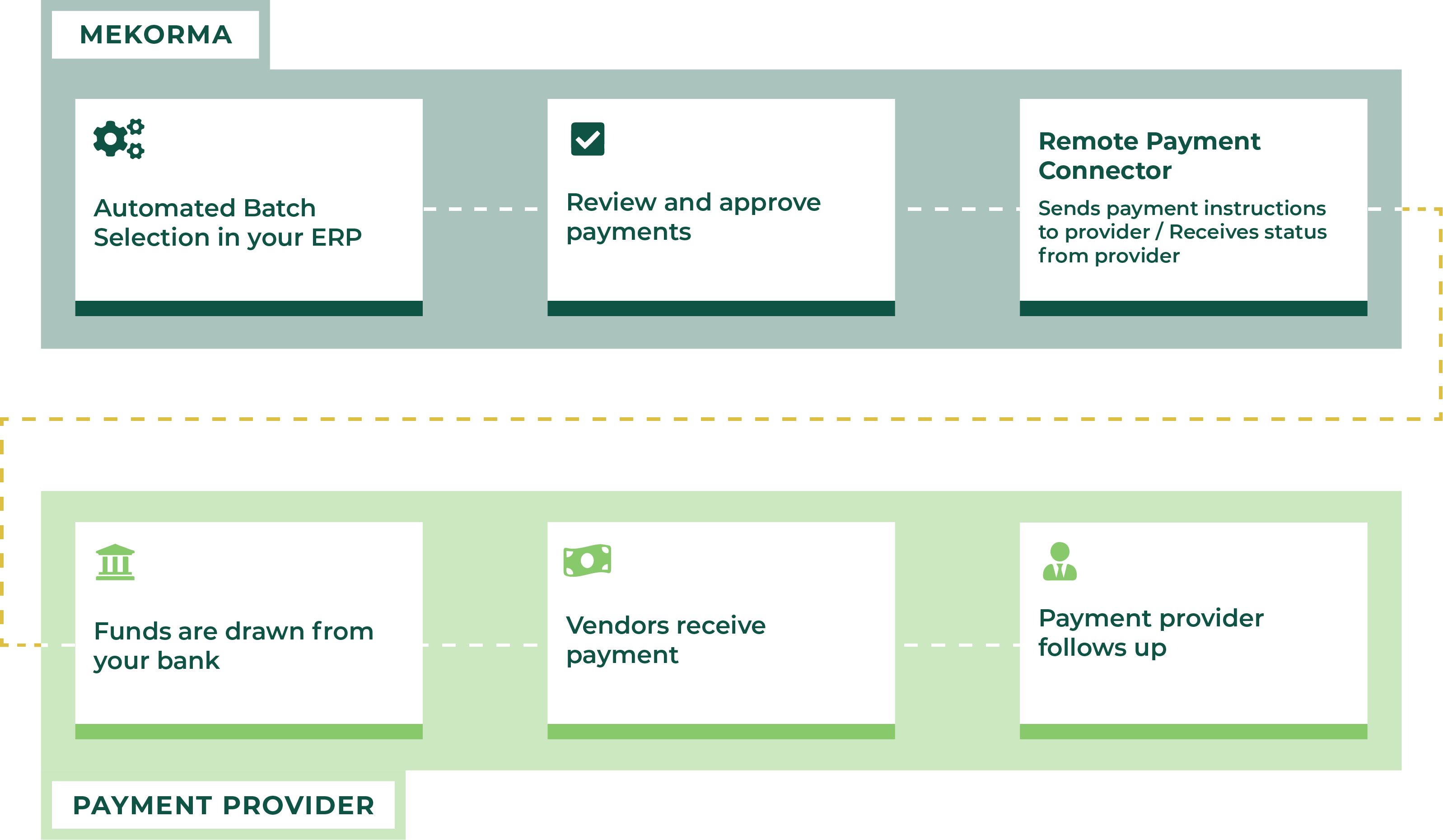

Mekorma Remote Payment Services (RPS) is an all-in-one check printing, electronic payment, and vendor enrollment service.

You'll never have to print another check again.

Remote Payment Services allows you to transmit your payments saving your Accounts Payable department time and money. Offer your vendors a choice: check, ACH, wire transfer, or virtual credit card.

Our cloud services are perfect for financial executives, accounting professionals, and accounts payable leaders who want to:

Streamline the vendor payment process

Reduce processing costs

Improve operational efficiency

Work remotely with greater ease

You keep control of who gets paid and when – we’ll take care of how.

Speak to an expertBenefits of Remote Payment Services

Maximize Efficiency & Go Paperless

- Eliminate the need to manually print, fold, stamp, and mail paper checks. You still have the option to print physical checks with Mekorma Payment Hub’s MICR technology!

- Send a single file from your ERP for all payment types.

- Maintain your ERP as your system of record.

Reduce Risk & Increase Security

- Mekorma secure approval workflow requires that payments are approved in Dynamics GP before they can be sent to the outsource provider.

- The outsource provider assumes liability for payments made through their platform. Check or EFT fraud is no longer yours to worry about.

Easy Vendor Management

- The cloud provider’s service team will onboard and continuously enroll your vendors to accept electronic payments, including virtual credit cards.

- Vendors have the freedom to choose what payment types they accept.

Generate Revenue with Rebate-Sharing

- Receive rebates on all vendor payments made by virtual card.

- Rebates typically cover or exceed the outsource provider's service fees, bringing revenue back into your organization.

In Addition:

Your ERP remains your system of record.

Payments are still processed, approved and posted into your ERP.

Payment approval workflow is implemented in your ERP to streamline approvals in advance of sending payments for processing.

All file and payment transfers are fully automated and seamlessly handled without adding additional steps.

You maintain complete control over what vendor payments are sent out and any you wish to print in-house.

The cloud payment provider provides fraud protection for all payments sent via their services. For those where they collect the vendor information directly, they take on liability.

Continuous onboarding encourages vendors to switch to electronic payment methods, reducing costs and gaining rebates.

Vendor payment inquiry services are available to those receiving electronic forms of payment.

A payment portal for your Accounts Payable department is also provided for additional visibility into the payments sent through the service.

Accounts Payable maintains complete control all while freeing themselves from the burden of:

Managing and securing vendor banking information

Stuffing and mailing checks

Fraudulent payment research and recovery

Controller

Havtech

FAQs

Yes, you can designate individual vendors to always have checks generated locally. Or you can temporarily disable the Remote Payment Connector so that payment batches are not sent to the cloud.

Our payment providers maintain a team of professionals who:

Continuously enroll your vendors in electronic payment types

Maintain vendor banking information

Perform Office of Foreign Assets Control (OFAC) screening

Manage vendor inquiries

Follow up on unprocessed payments

Approvers can review and approve payments within a designated threshold range. Payments cannot be sent to the provider until approvals have been completed by the appropriate people.

For a complete overview of how both Mekorma and the cloud provider keep your data safe, follow this link.

Our payment integration connects to Corpay and Priority Commerce services.

The Mekorma team will work with you during the discovery process to determine which partner will provide the best ROI for your unique circumstances. There are a number of factors that go into the decision process - see more here.