How an HVAC Company Grew with Automated Payments

Client Profile

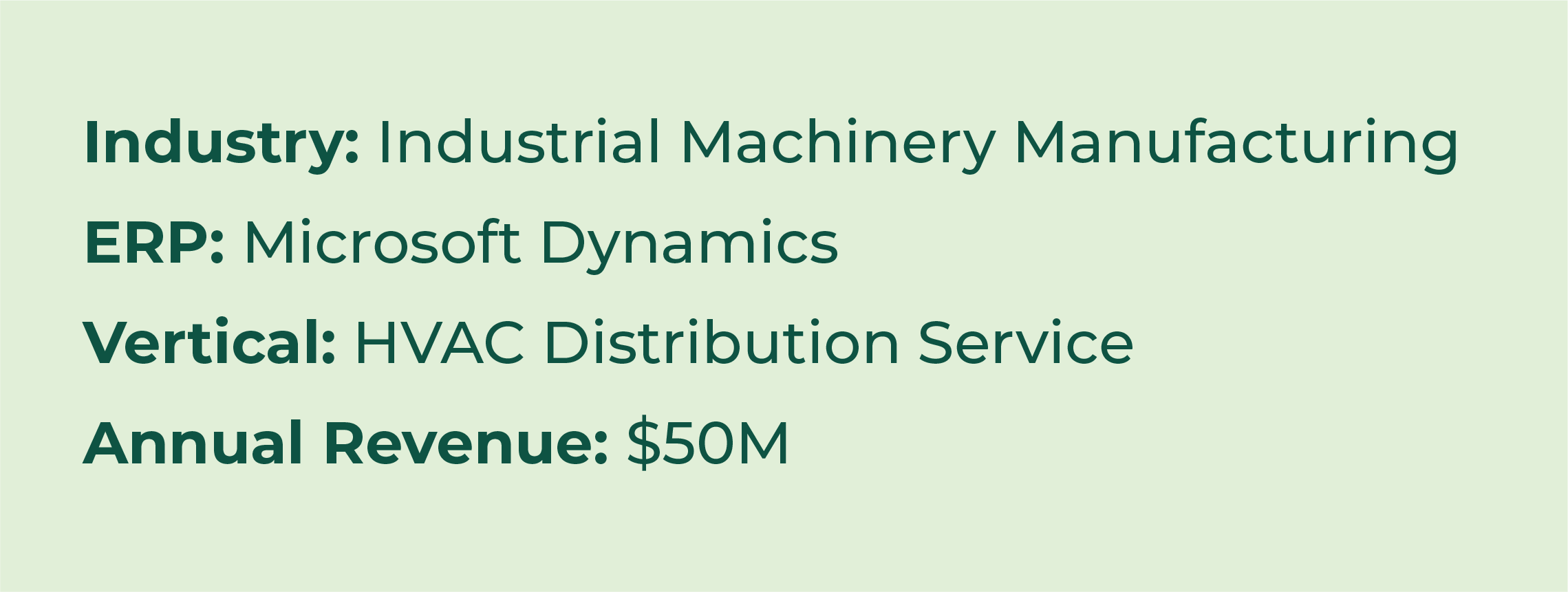

Havtech, a group of six vertically integrated HVAC-related companies, has units in manufacturing, parts, distribution, service, technology, and real estate. Their centralized three-person finance department utilized Microsoft Dynamics, and 100% of their vendor payments were made by check.

They saw growth opportunities in new geographies but needed scalable back-office processes to support it.

Fortunately, they had a forward-looking AP department eager to stamp out inefficiencies. The team brought in Mekorma, an ISV that specializes in streamlining and optimizing AP or Accounts Payable workflows in Dynamics. After implementing process improvements, Mekorma introduced Havtech to Remote Payment Services to help achieve their goal of permanently eliminating paper checks.

Challenges

Prior to bringing in Mekorma, paying vendors was extremely complicated. The team at Havtech had to log into each company separately in Dynamics, mark invoices for payment, and initiate check batches. They were bogged down in redundant processes and chasing down check signatures.

Mekorma Payment Hub and the Action Board streamlined that workflow and made it more secure. The Havtech team could then generate checks across all six companies from a single dashboard. They could also print checks pre-signed by approvers.

![]()

Although this greatly improved their existing process, Havtech was still reliant on paper checks. Vendors were requesting electronic payments, but undertaking both vendor enablement and the shift from their existing workflow in Microsoft Dynamics was too heavy of a lift for their small team. They were also concerned about having to store and maintain vendor banking data.

When COVID hit, the situation became dire. Nearly every process transitioned easily to remote work — except for check processing.

The team was running up to 30 check batches per week, which included printing and mailing 250+ checks

Time-consuming manual work left the AP team too busy to reconcile all vendor statements

Some payments were delayed, causing friction with vendors

During COVID, the AP leader ended up adding 3+ hours of work per week to her existing workload just to print and mail checks

Solution

Havtech began looking for a payment automator at the same time Mekorma began offering an outsourced payment solution. Havtech decided to implement Mekorma Remote Payment Services (RPS), allowing them to initiate payments in Dynamics exactly the same way, retaining all of the security and controls built by Mekorma. But now, instead of printing every payment in-house, a single file is sent electronically through RPS.

Through RPS, a secure outsourced service provider pays all vendors by the most advantageous means — virtual card for vendors who accept it, then by ACH and by check only when vendors don’t accept electronic payments

The outsourced service provider handles all vendor enablement on a continuous basis

The outsourced service provider secures vendor banking data and offers full acceptance of payment risk and responsibility for qualified payments

Havtech retains complete payment visibility while the outsourced service provider, through Mekorma RPS, handles time-consuming obstacles in the payments process, such as uncashed checks

Results

Havtech’s AP team was “ecstatic” when they learned they’d never have to handle checks again.

Thanks to Remote Payment Services, the team reports they are now working more efficiently, are more focused, and morale has improved. Since implementation, two employees have been promoted, turnover is zero, and the team has been able to dedicate their time to higher-value work.

In tandem with Mekorma, Havtech reduced a seven-step process spanning two systems to just one step, eliminating 12 hours per month of work

Between rebates and reduced costs, the program pays for itself and even generates revenue

Check payments went from 100% of payments to 41%; 38% percent of payments are now made by ACH; and 21% by virtual credit card

Reconciliation is much simpler because multiple batches are consolidated into a single payment sent through RPS.

Eliminating sensitive banking data sitting in piles of paper around the office has significantly improved security and controls

The company is now poised to launch three new companies

The AP team now has the time to reconcile statements and the purchasing team can now focus more on building relationships with manufacturers and vendors