Guide to Remote Payment Services Pricing

Outsourcing vendor payments can relieve your AP team of tedious manual work and help you scale your business without adding headcount. It can also greatly reduce your risk of fraud and enable your team to work remotely.

If you are considering outsourcing with Mekorma Remote Payment Services, your company’s payment volume and mix will ultimately determine what your costs will be. In addition, the use of virtual credit cards will generate rebates which will offset the costs.

Mekorma partners with Corpay to provide this joint solution.

Factors that determine the cost of Remote Payment Services

The associated costs of payment outsourcing are primarily usage-based; your company will pay transaction fees for the number of payments processed each month, a flat monthly service fee, and for initial implementation.

Transaction Fees

Transaction fees will apply depending on the number of payments you send monthly. Rates may differ for each type of payment sent - checks, ACH, and virtual credit card payments carry different costs. Fees can vary from free to $1.50 per payment sent, depending on the type of payment.

Comparing outsourcing costs and benefits to in-house payment processing offers significant savings

To analyze what you currently pay to process payments in-house, factor in the following:

Per check cost for stock (pre-printed or blank)

Toner cartridge cost

Postage

Envelopes

ACH / wire fees, based on your bank’s transaction and file fees

The number of hours per week dedicated to processing (including batching, approving, hand signing, and sending payments), multiplied by the hourly wage of the people involved

Average losses due to fraudulent activities, internal or external

On average, your in-house processing costs will be between $4 and $20 per check.

Monthly Network Services Fees

In addition to fees per transaction, the payment provider charges a flat monthly fee for services. This will be between $100 to $500 per month. On occasion, for particularly complex clients, this monthly fee can be higher.

Monthly fees are typically offset by the rebates offered.

Rebates Can Offset the Monthly and Transaction-Based Fees

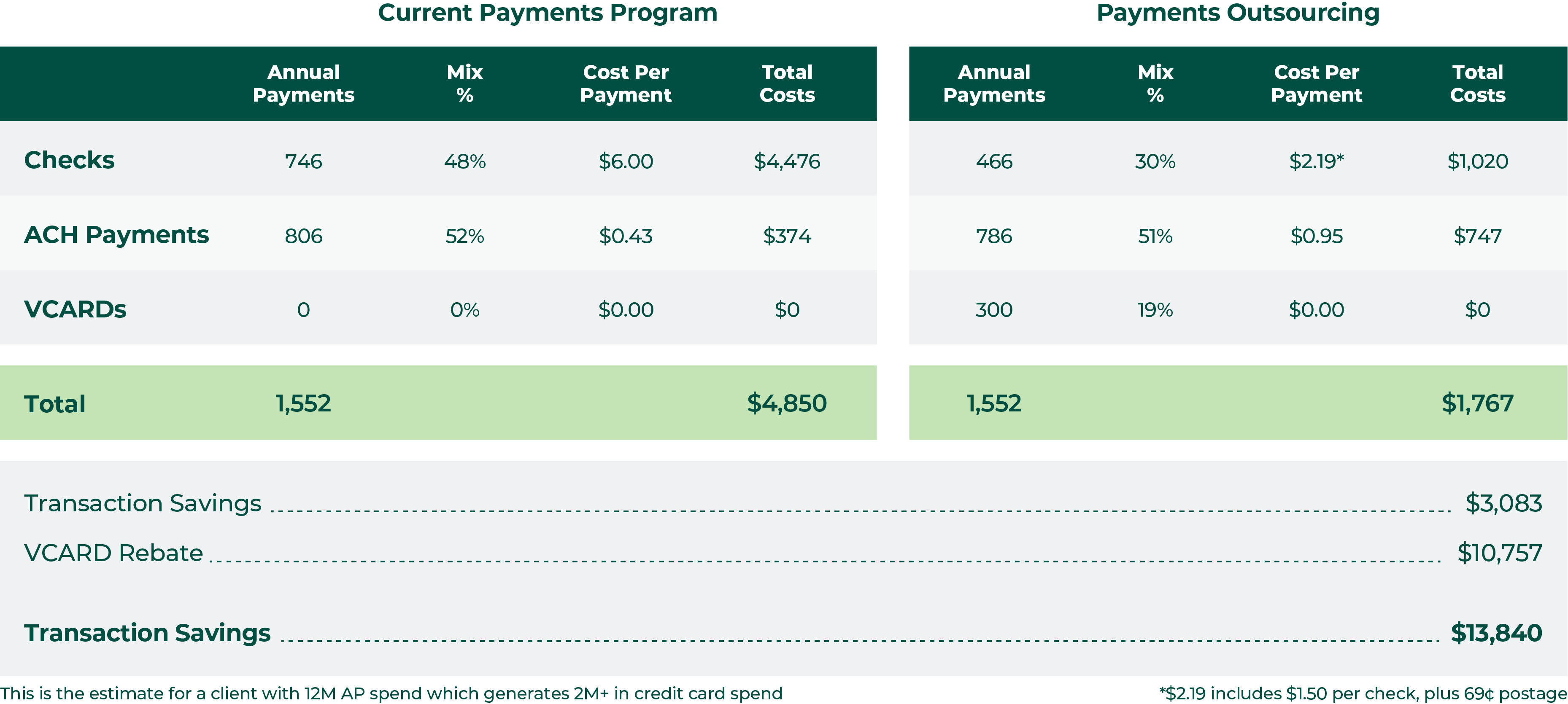

In the table below, you’ll see an example of the estimated ROI for a Mekorma client that processes 1,552 payments per year. The client currently spends roughly $4,823 annually to process payments in-house. Even though they send more ACH payments than paper checks, almost all their current costs are going towards printing and mailing paper checks.

The ACH fee of $0.43 is an estimate and this will vary depending on what your bank charges per transaction, for the file submission, and the average number of transactions per file submitted. Banks may say ACH costs $0.05-$0.25 per transaction, but they also charge a per-file fee – it can be as high as $10.

With a remote payment solution, this client can potentially cut their costs by 77% as soon as they start outsourcing. Their rebate potential for the year is more than $10,000 from payments made by virtual card. While ongoing service fees are on the higher end of the scale - $500 per month - that still leaves them with an estimated profit of $8,488 per year.

One-time Costs

Technical implementation of the software that supports Remote Payment Services is set based on the number of checkbooks and company databases you are configuring. Additional fees may be charged if your system requires an upgrade, you need a customization,

or you want to add functionality.

Remote Payment Connector

The Remote Payment Connector allows your ERP to communicate with the outsource provider’s platform. The price for the Connector is $950 annually.

Implementation of the Connector is $5,000. This includes five checkbooks as part of the configuration; additional checkbooks over the initial five will cost $200 each.

In addition to these costs, we’ll need to review your current system to see if additional fees are required.